Toronto, Ontario -(Newsfile Corp. – January 18, 2024) – Resouro Strategic Metals Inc. (TSX-V: RSM)

(FSE:BU9) (“Resouro” or the “Company“) is pleased to provide an update on activities at the Tiros Rare

Earths and Titanium project in Brazil (“Tiros Project” or “Project”).

Key highlights from recent assays received include;

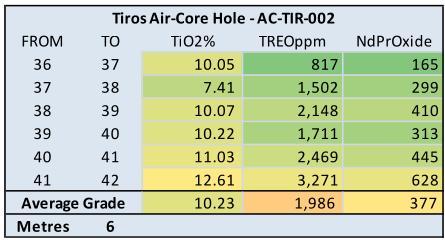

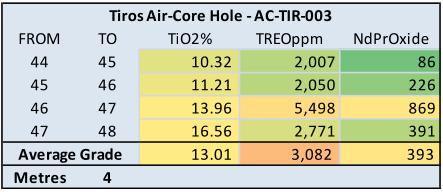

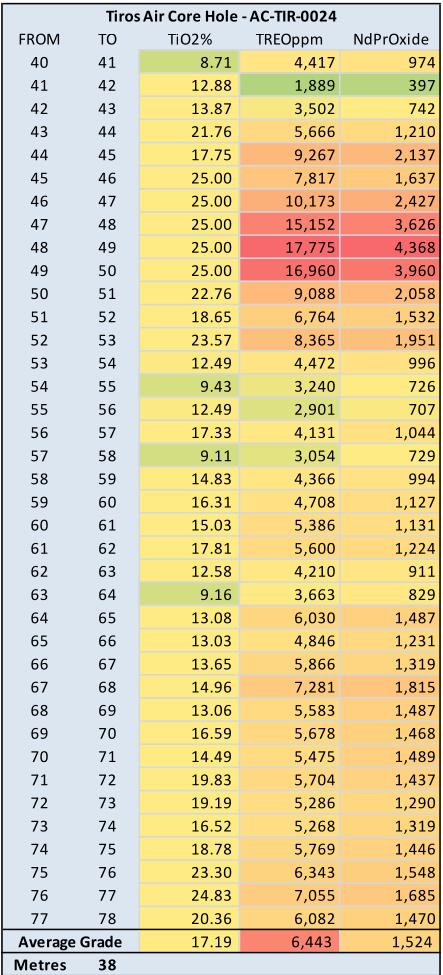

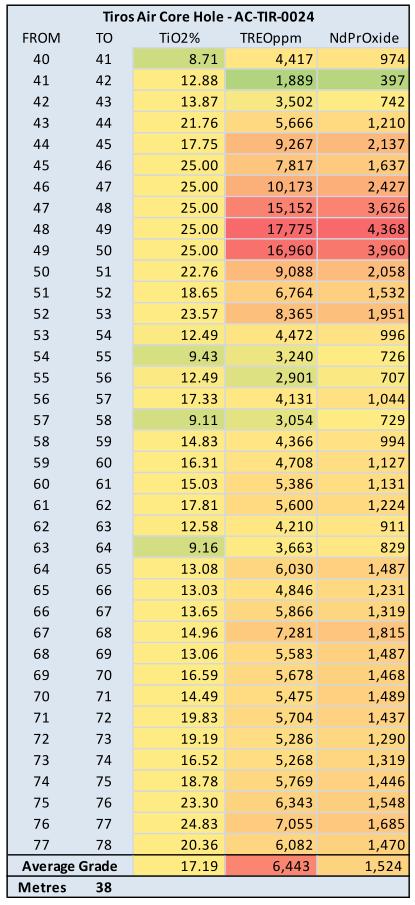

– 38 metres at 6,444 ppm TREO with 1,524 ppm NdPr and 17.5% TiO2 from 40m (Aircore)

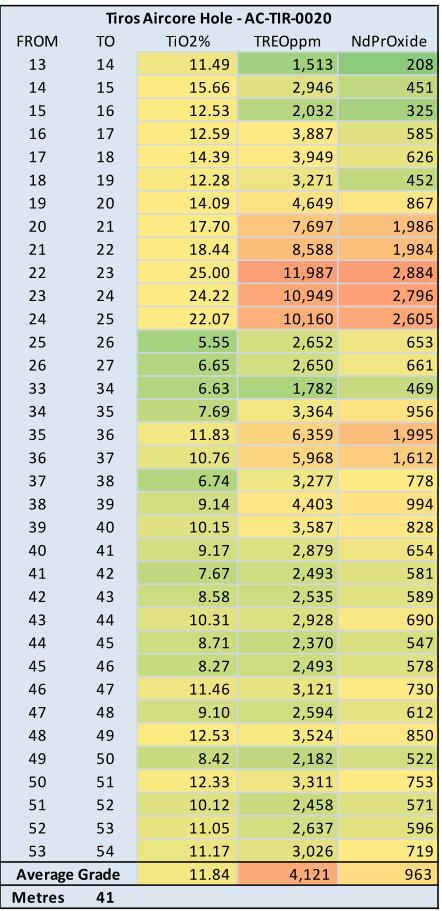

– 34 metres at 4,216 ppm TREO with 1,020 ppm NdPr and 10.6% TiO2 from 24m (Aircore)

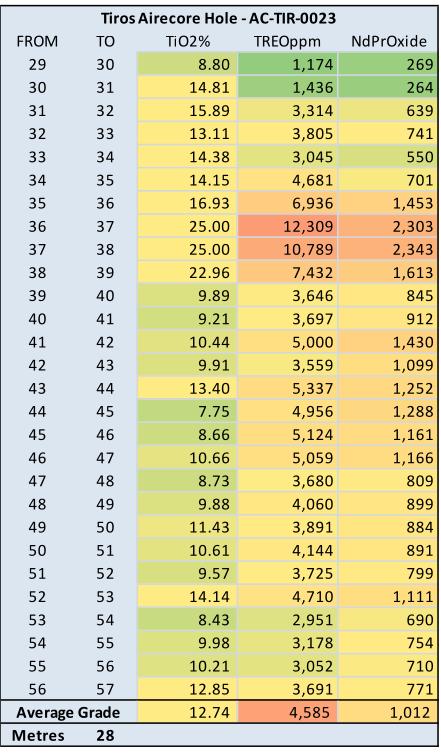

– 28 metres at 4,585 ppm TREO with 1,012 ppm NdPr and 12.7% TiO2 from 29m (Aircore)

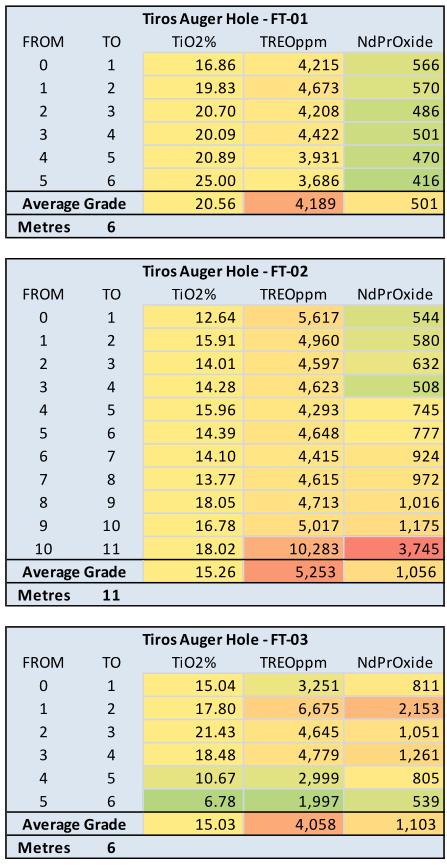

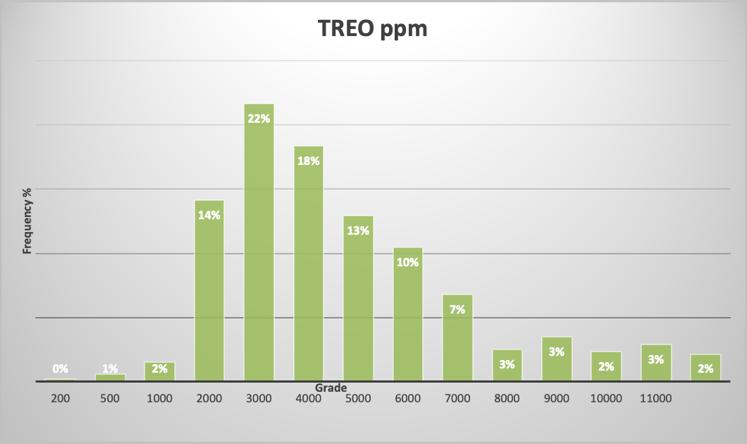

– 12 metres at 8,150 ppm TREO with 1,575 ppm NdPr and 20% TiO2 from surface (Auger)

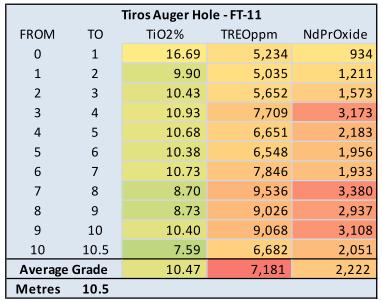

– 10.5 metres at 7,181 ppm TREO including 2,222 ppm NdPr and 17.5% TiO2 from surface (Auger)

– 14 metres at 4,340 ppm TREO with 911 ppm NdPr and 12.1% TiO2 from 29m (Auger)

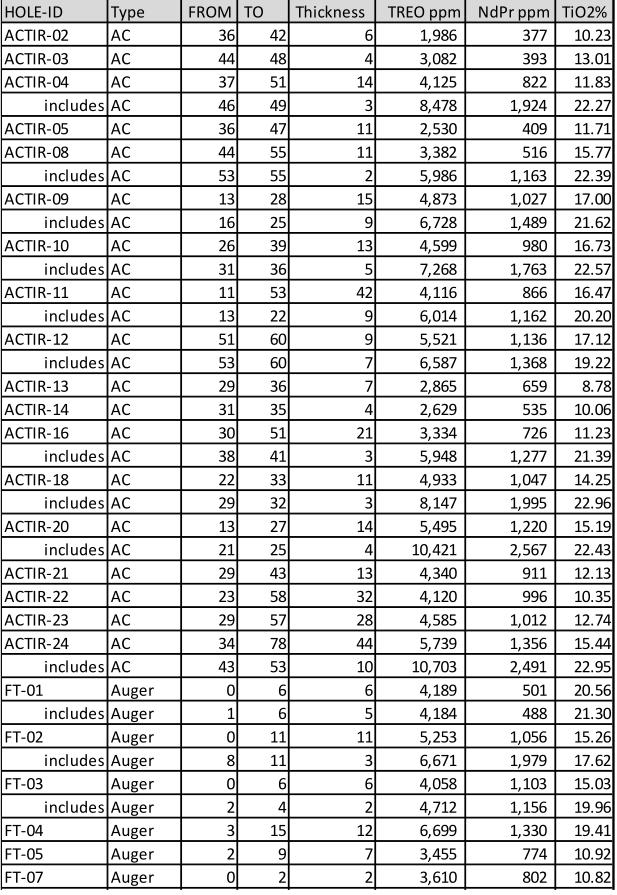

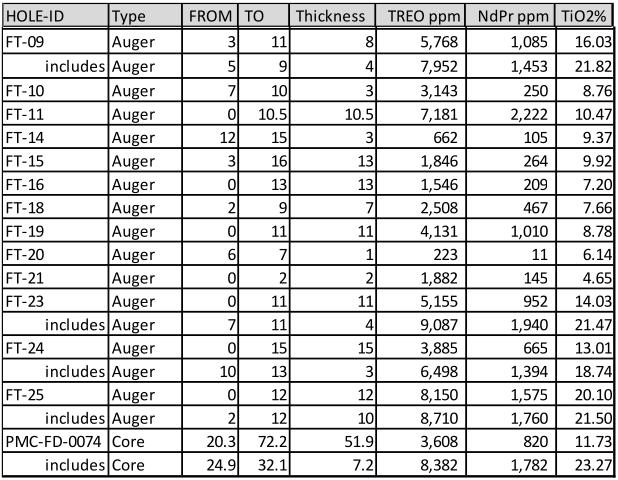

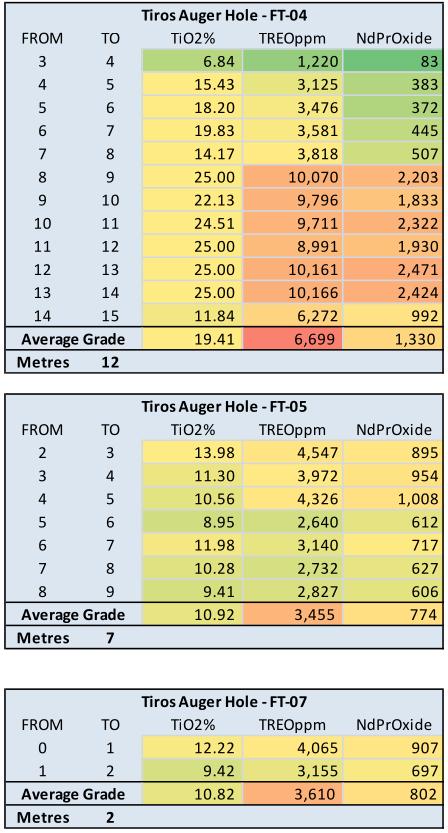

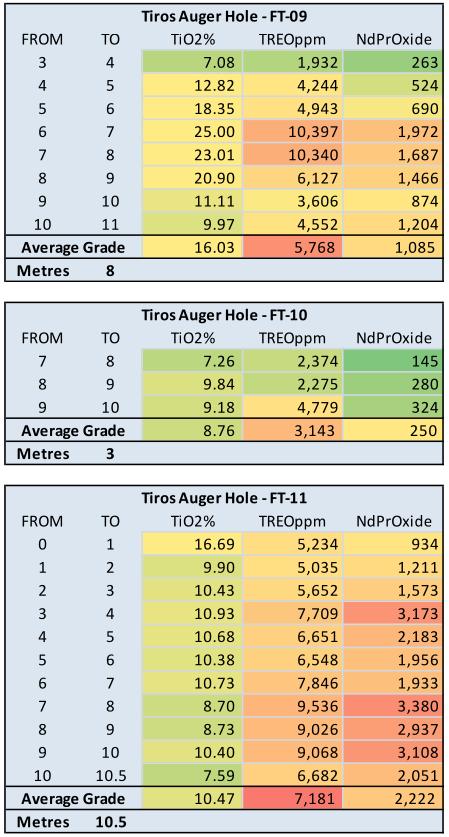

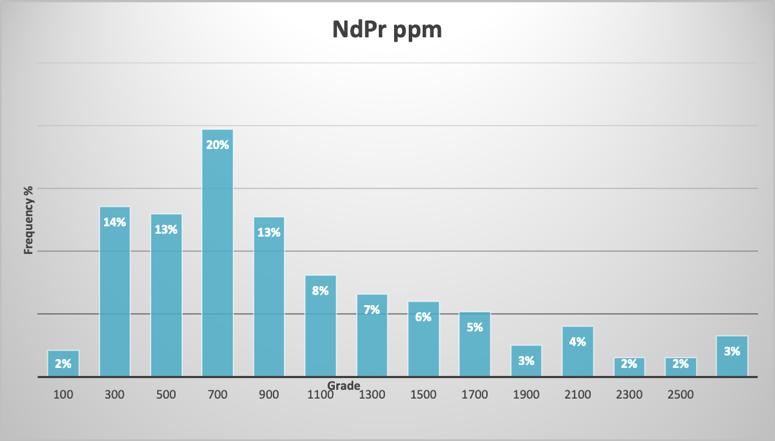

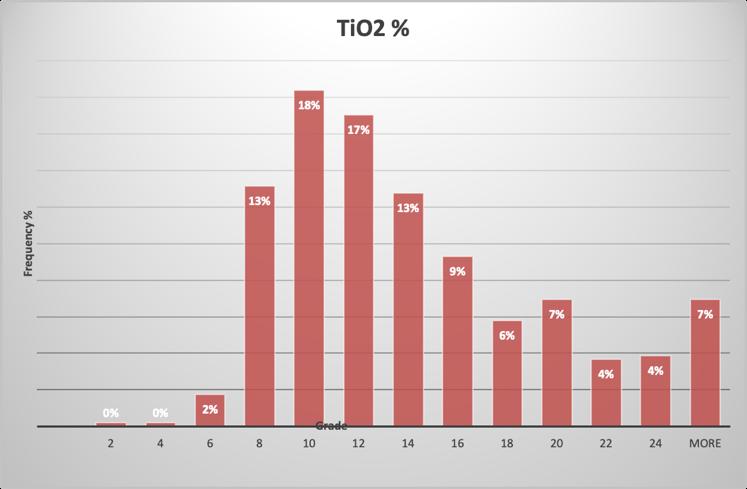

In summary, the 518 samples taken from the 13 holes (AC and Auger) in the recent campaign

produced (see figures 1 – 3)

– 83% of the samples had a TREO grade above 3,000 ppm;

– 84% of the samples had a NdPr grade of over 500 ppm; and

– 85% of samples had a TiO2 grade of over 10%.

Note: The potential quantity and grade are conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Commenting on the significance of these high-grade assays results from Tiros, CEO and President

of Resouro, Chris Eager, said:

“We are extremely pleased with the assay results from the recent drilling campaign at Tiros, which demonstrate both the highest grades (TREO, NdPr and TiO2) and thicknesses we have seen at the project to date. Drilling to date has consistently demonstrated thick intercepts of high-grade TREO and TiO2. The latest results continue to indicate Tiros could be a globally significant REE and TiO2 project.”

Figure 1: Grade Distribution of Total Rare Earth Oxides from drilling results received to date from the Tiros Project

Figure 2: Grade Distribution of NdPr Rare Earth from drilling results received to date from the Tiros Project (Note: The distribution percentages outlined in Figure 2 are rounded and result in a value slightly above 100% when combined).

Figure 3: Grade Distribution of Titanium Dioxide from drilling results received to date from the Tiros Project

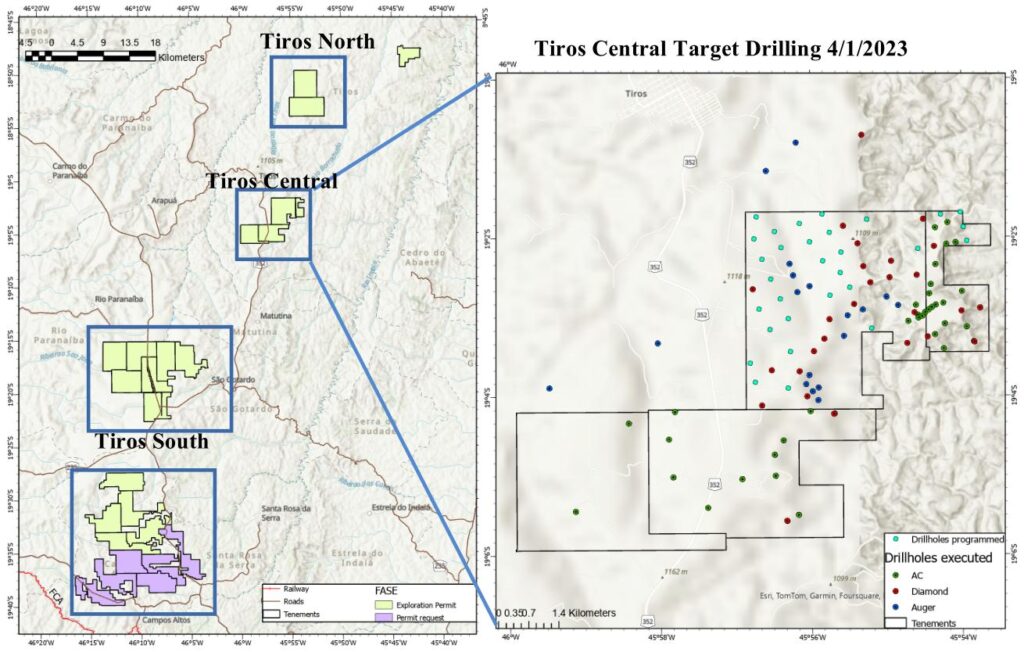

Resouro has focused drilling on the Tiros Centre (see figure 5) which covers 44 km2 in the centre of the Tiros Project with its northern tenements (Tiros North) also producing excellent results. The Tiros Centre covers approximately 9.5% of the total 477 km2 of the Tiros Project. The program includes Air-Core, Diamond and Auger drilling, all to provide data for a maiden Resource Estimation.

Resouro has now completed 257m over 25 auger holes, 1,562m over 30 Air-Core holes and, 1,634m over 26 Diamond holes, excluding historical drilling by Vincenza and Iluka with 950m over 20 holes of Air-Core drilling and 1 diamond drill hole at 82m by Vincenza. The assay results published in this release are the first of significant number of drill samples currently in the laboratory for assay.

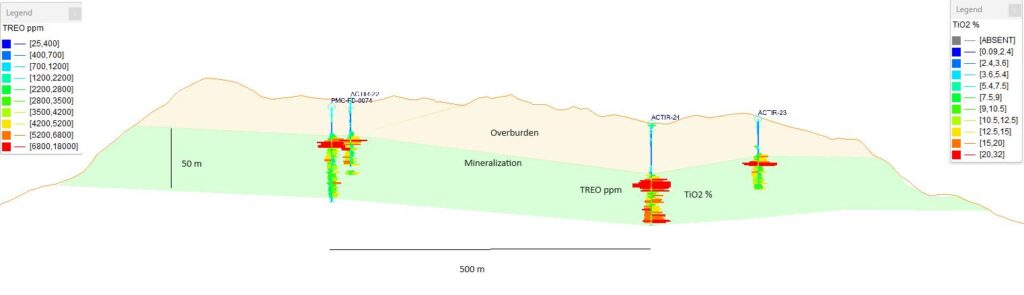

The recent results from Tiros confirm the Company’s technical analysis of the geology showing a high grade REE and Tio2 resource below overburden in the plateaus of the regional Capacete Formation indicating a relative homogeneous globally significant high grade ore body as indicated in figure 4 below.

Figure 4: a typical resource section of the Tiros Project across the plateaus of the Capacete Formation.

Figure 5: Tiros Tenements Location Map (left) and current drilling program hole locations on Tiros central (right)

Quality Assurance Quality Control

A QA/QC program is in place for every batch of samples sent to the laboratory including blanks, different types of standards, for REE and titanium, and also field duplicates. Further, a number of samples in each batch are later chosen for testing in a secondary laboratory and in the primary laboratory, as pulp or coarse duplicates.

Qualified Person (“QP”)

The technical content of this news release has been reviewed and approved by Rodrigo Mello B.Sc.

Geology, FAusIMM and a qualified person as defined by National Instrument 43-101. Mr Mello has

reviewed and verified the drilling and assay data included in this announcement.

Important Notice

The Company refers to its release on SEDAR Plus on 17 August 2023 titled “Resouro Completes

Historical Desktop Study Including Historical Resource at Tiros Rare Earths and Titanium Project in

Brazil” (Release), which included disclosures regarding the Company’s initial resource target and

historical resource estimates.

The Company advises that the initial resource target and resource estimates table disclosed in the

Release were not compliant with either the standards prescribed by National Instrument 43-101 –

Standards of Disclosure for Mineral Projects or the 2012 Edition of the Joint Ore Reserves Committee

Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. The Company retracts that information and advises that investors should not rely on the retracted information in assessing the Company’s Tiros Rare Earths and Titanium Project or for any investment

decision.

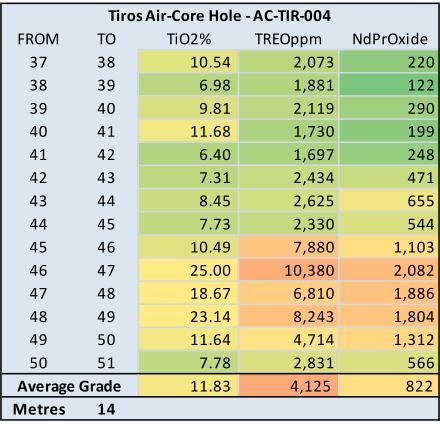

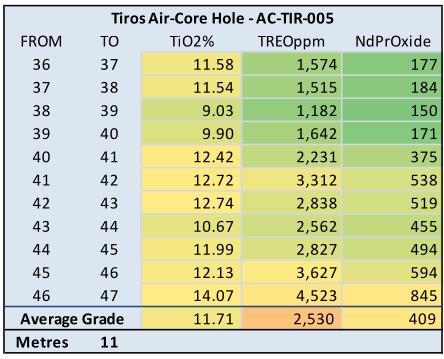

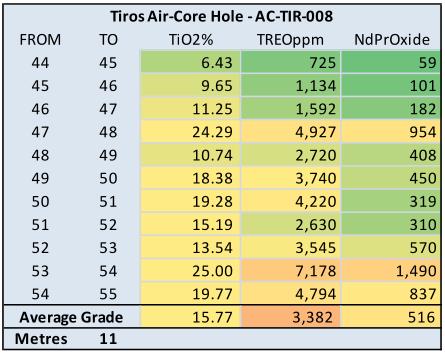

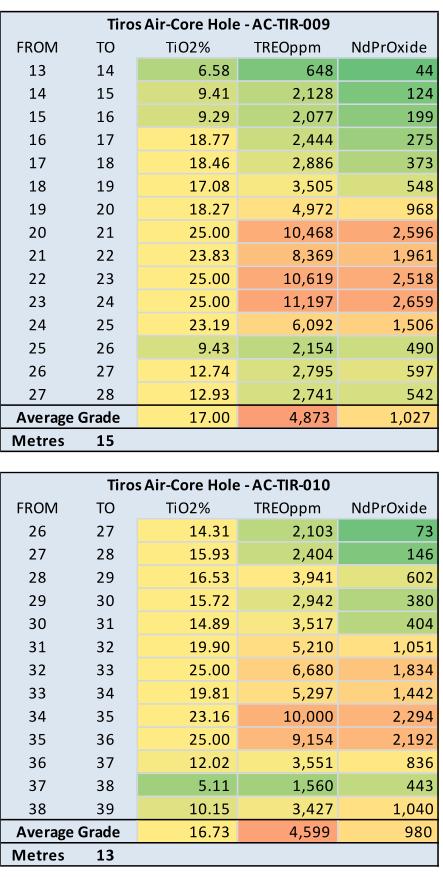

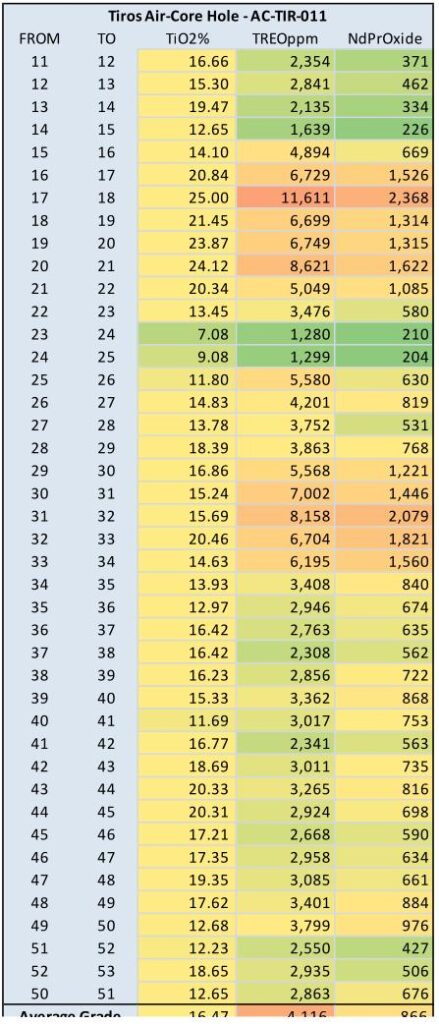

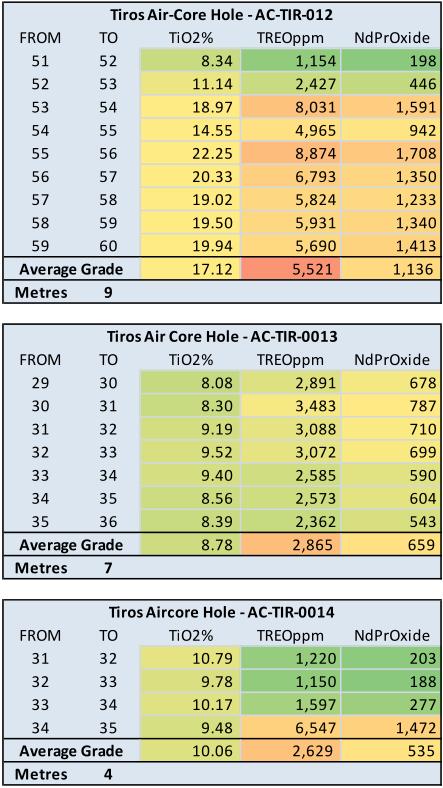

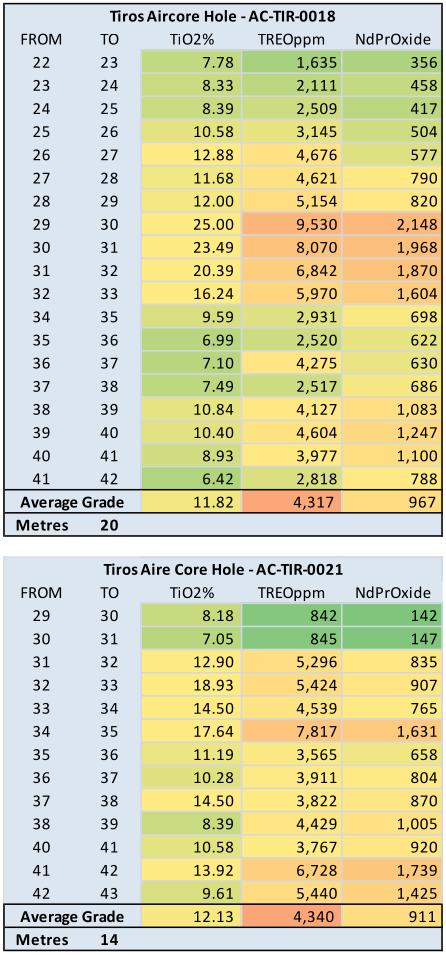

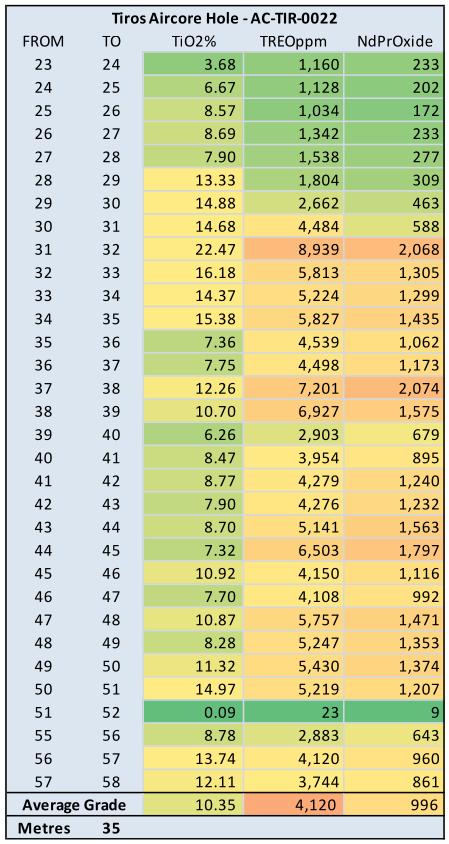

| Figure 6 – Grade Profile from Selected Air-Core and Auger Holes | Figure 7: Typical Diamond Drill Core from TirosShowing Capacete Formation Clays |

|

|

Tiros Acquisition Update

Further to the Company’s recent announcements regarding the acquisition of Tiros, the Company is pleased to advise that it is closing out the final states of the acquisition with one of the key equirements, being the approval of the issue of 4 million options to the Company’s President & CEO, Chris Eager, approved by shareholders at the special meeting held earlier this week with the results summarised below. The remaining outstanding items relate to the submission of a NI 43-101 technical report in relation to the Tiros Project and a report on the Project’s title and accompanying opinion to that effect. These matters will be rounded out in coming days and, subject to confirmation by the TSXV that the documents submitted are satisfactory, the Company will formally proceed to close the acquisition and issue the consideration equity.

Meeting Results

Further to the Company’s news release dated December 22, 2023, on January 16, 2024, the shareholders of the Company were asked to approve, among other matters, a new stock option plan (the “Amended and Restated Option Plan“) at a special meeting of the shareholders (the “Meeting”).

At the Meeting, four resolutions were placed before the shareholders. The first of which was a resolution requiring ordinary and disinterested shareholder approval to amend the stock option plan, to, among other things, permit the Company to issue stock options exercisable for up to 14,193,752 common shares of the Company, being 20% of the issued and outstanding Common Shares as at the date of the management information circular in respect of the Meeting (the “First Resolution”). The second, a resolution requiring two separate disinterested shareholder approvals of the grant of 4,000,000 options with an exercise price of $0.20 per Common Share (the “Options”) to Christopher Eager, President and Chief Executive Officer of the Company (the “Second Resolution”). The third, a resolution requiring disinterested shareholder approval of the issuance of additional options equal to up to 10% of the issued and outstanding common shares of the Company to Insiders of the Company, as such term is defined by the policies of the TSX Venture Exchange, within the 12 month period following the Meeting, in excess of the grant of the Options (the “Third Resolution”). The fourth, a resolution requiring disinterested shareholder approval of the issuance of additional options equal to up to 5% of the issued and outstanding common shares of the Company to Christopher Eager within the 12 month period, following the Meeting, in excess of the grant of the Options (the “Fourth Resolution”).

A total of 25,305,276 Common Shares, or 99.99% of the votes cast at the Meeting by holders of Common Shares present or represented by proxy were cast in favour of the First Resolution with respect to the ordinary resolution approval required. 7,149,527 Common Shares, or 99.99% of the votes cast at the Meeting by holders of Common Shares present or represented by proxy were cast in favour of the First Resolution with respect to the disinterested approval required. Similarly, a total of 7,149,527 Common Shares, or 99.99% of the votes cast at the Meeting by holders of Common Shares present or represented by proxy were cast in favour of the Second Resolution, Third Resolution and Fourth Resolution with respect to each of the levels of disinterested approval required for each of the relevant resolutions.

Details of all matters voted upon at the Meeting are provided in the management information circular in respect of the Meeting, a copy of which is available on the Company’s SEDAR+ profile.

About the Company

Resouro is a Canadian-based mineral exploration and development company focused on the discovery

and advancement of economic mineral projects in Brazil, including the Tiros Project in Minas Gerais

and the Novo Mundo Gold Project in Mato Grosso. The Tiros Project represents 25 mineral

concessions totaling 477 km2 located in the state of Minas Gerais, one of the most infrastructurally

developed states of Brazil, 350 km from Belo Horizonte, the state capital.

This announcement has been authorised by Mr. Chis Eager, on behalf of the Board of Directors.

This announcement has been authorised by Mr. Chis Eager, on behalf of the Board of Directors.

Chris Eager, President & CEO

RESOURO STRATEGIC METALS INC.

For further information, please contact the Company at:

+1 416 642-1807 (Principal Office – Toronto, Canada)

Chris Eager, CEO

[email protected]

Forward-Looking Information

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic

conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required, including obtaining conditional and final acceptance of the TSXV; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in the mining industry; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws

and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities of the Company in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities of the Company in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available

Selected High Grade Drilling Intervals to Date